Navigating the financial landscape is crucial for the success of small businesses. In this blog post, we will explore practical financial literacy tips tailored for small business owners, ensuring they can make informed decisions and secure the financial health of their ventures.

1. Mastering Budgeting for Small Businesses:

Establishing and maintaining a budget is the cornerstone of financial literacy. Small business owners should understand income sources, allocate funds wisely, and track expenses meticulously. This practice enables better financial control and planning.

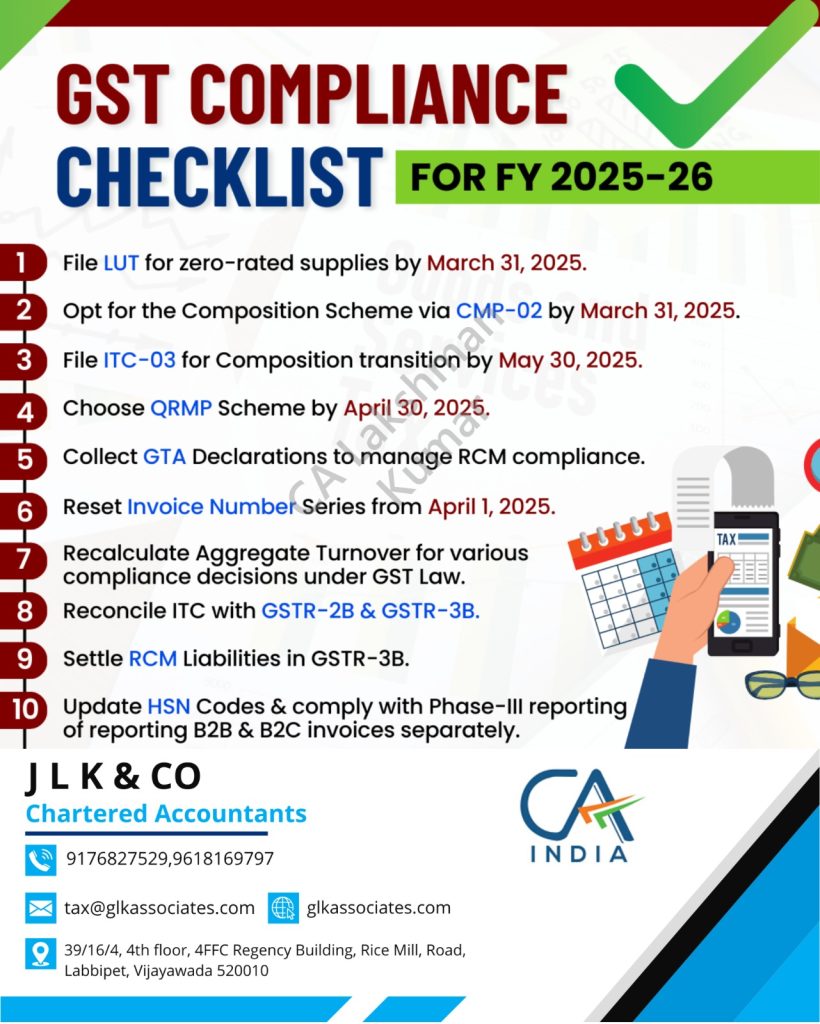

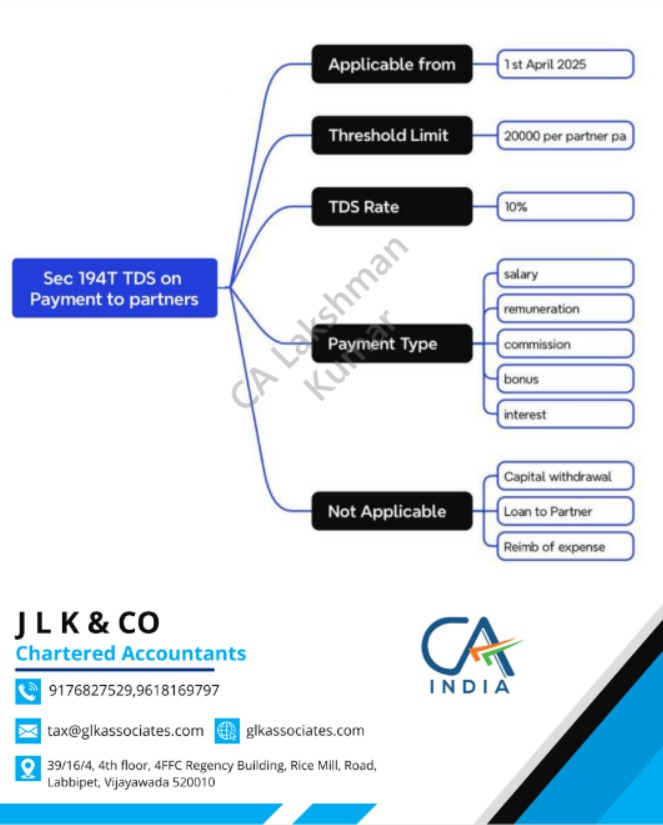

2. Understanding Small Business Taxes:

Small business owners must grasp the intricacies of taxes, including deductible expenses, credits, and compliance requirements. Familiarity with tax regulations ensures businesses can optimize their tax position and avoid potential pitfalls.

3. Effective Cash Flow Management:

Cash flow is the lifeblood of small businesses. Learn to manage receivables and payables efficiently to maintain a healthy cash flow. Adequate cash flow management safeguards against financial hiccups and supports business growth.

4. Utilizing Small Business Loans Wisely:

When considering loans, small business owners should comprehend the various options available and choose the one aligning with their needs. Understanding loan terms, interest rates, and repayment structures is crucial for responsible borrowing.

5. Investing in Financial Education:

Small business owners should continually educate themselves on financial principles. Attend workshops, webinars, or seminars to stay updated on industry trends, accounting practices, and financial management strategies.

6. Implementing Technology for Financial Efficiency:

Embrace financial tools and software to streamline bookkeeping, invoicing, and financial reporting. Leveraging technology enhances accuracy, saves time, and provides a clearer picture of the business’s financial health.

7. Monitoring Key Financial Ratios:

Understanding financial ratios like liquidity, profitability, and debt-to-equity is essential. Regularly monitoring these ratios helps small business owners assess performance, identify areas for improvement, and make informed financial decisions.

8. Risk Management and Insurance:

Small business owners should evaluate potential risks and implement suitable insurance coverage. This proactive approach safeguards against unforeseen events, such as property damage, liability claims, or disruptions in operations.

9. Building a Contingency Fund:

Establishing a contingency fund for unexpected expenses or economic downturns is a prudent financial move. This fund acts as a safety net, providing stability during challenging times.

10. Seeking Professional Financial Advice:

Consider consulting with financial professionals, accountants, or business advisors. Their expertise can offer valuable insights, especially when dealing with complex financial decisions or regulatory compliance.

Conclusion:

Financial literacy is a powerful tool for small business owners, empowering them to make informed decisions that contribute to the sustained success of their ventures. By mastering budgeting, understanding taxes, and continuously educating themselves, small businesses can navigate the financial landscape with confidence. Embrace these financial literacy tips to ensure the financial health and longevity of your small business.